Blog

Data Centre Blog 8.0 - Growth of Colocation third-party and Hyperscale Data Centres in Ireland, with new campus facilities set to change the market from 2021 onwards.

14 January 2021

The DCP Blog 8.0 looks at the growth of Colocation third-party and Hyperscale Data Centres in Ireland, with new campus facilities set to change the market from 2021 onwards.

When combined with the Hyperscale Data Centres built by the digital technology providers the Irish potential Data Centre market expands to 550,000 m2 of Data Centre raised space and 840 MW of power. It is comparable with France (which is the fourth largest Data Centre market in Europe).

January 2020 – The third-party Irish Data Centre market is undergoing a steady evolution with the introduction of new third-party Data Centre campus facilities, notably from K2 Data Centres, Echelon Data Centres and CyrusOne. Data Centre Providers are building out larger facilities, which when fully built out, have the capacity to double the total amount of third-party Data Centre raised floor space in Ireland to over 200,000 m2.

Overview – The Irish Data Centre Market

Ireland has become one of the most significant markets for Data Centres in Europe, with multiple facilities established by the Hyperscale digital technology companies including Amazon, Facebook, Google and Microsoft around the Dublin area. The key digital technology Hyperscale Data Centres under construction in the Dublin area are shown in the table in Figure 1 below:

Figure 1 – A table showing the key Data Centres in Ireland under construction by the Hyperscale digital technology providers

|

Data Centre |

Location |

Development Phase |

Est m2 |

Est MW |

|

AWS |

Ballycoolin |

Under construction |

20,000 |

34 |

|

AWS |

West Dublin |

Under construction |

20,000 |

34 |

|

AWS |

Tallaght |

Completed |

20,000 |

34 |

|

AWS |

Clonshaugh |

Completed |

20,000 |

34 |

|

AWS |

Clonshaugh |

Completed |

20,000 |

34 |

|

AWS |

Grange Castle |

Planning Consent |

20,000 |

34 |

|

|

Clonee (Phase II) |

Under construction |

25,000 |

38 |

|

Microsoft |

West Dublin |

Under construction |

21,000 |

32 |

|

Microsoft |

West Dublin |

Under construction |

21,000 |

32 |

|

Microsoft |

West Dublin |

Under construction |

21,000 |

32 |

|

EdgeConneX |

West Dublin |

Under construction |

7,000 |

12 |

|

Totals |

215,000 m2 |

350 MW |

Source: Host in Ireland & DCP

Industry body Host in Ireland has identified eleven Data Centre facilities under construction, with the majority being provided for dedicated space including - Amazon/AWS, EdgeConneX, Facebook and Microsoft all building new facilities in the Dublin area.

Ireland – Colocation and Hyperscale Data Centres

Host in Ireland’s Biannual Report published in November 2020 has identified Data Centre facilities in Ireland with total design capability power of up to 834 MW with the Hyperscale Data Centre Providers accounting for 80 per cent of total capacity.

Investments by the digital technology Hyperscale Data Centre Provider has helped make Dublin one of the largest Data Centre markets in Europe and is outranking the current third-party Data Centre colocation market by around five to one.

By contrast the Irish third-party Data Centre market consists of 27 Data Centre facilities and 14 Data Centre Providers - with the key Data Centre Providers including Digital Realty, Equinix, Interxion and Keppel Data Centers – with 113,000 m2 of space and 140 MW of power in total.

The third-party colocation Data Centre segment accounts for half of the number of Irish Data Centre facilities but only around twenty per cent of total space and power - with the average size of Hyperscale facility being much larger than the average third-party colocation facility.

When combined with the Hyperscale Data Centres built by the digital technology providers the Irish potential Data Centre market expands to 550,000 m2 of Data Centre raised space and 840 MW of power. It is comparable with France (which is the fourthlargest Data Centre market in Europe).

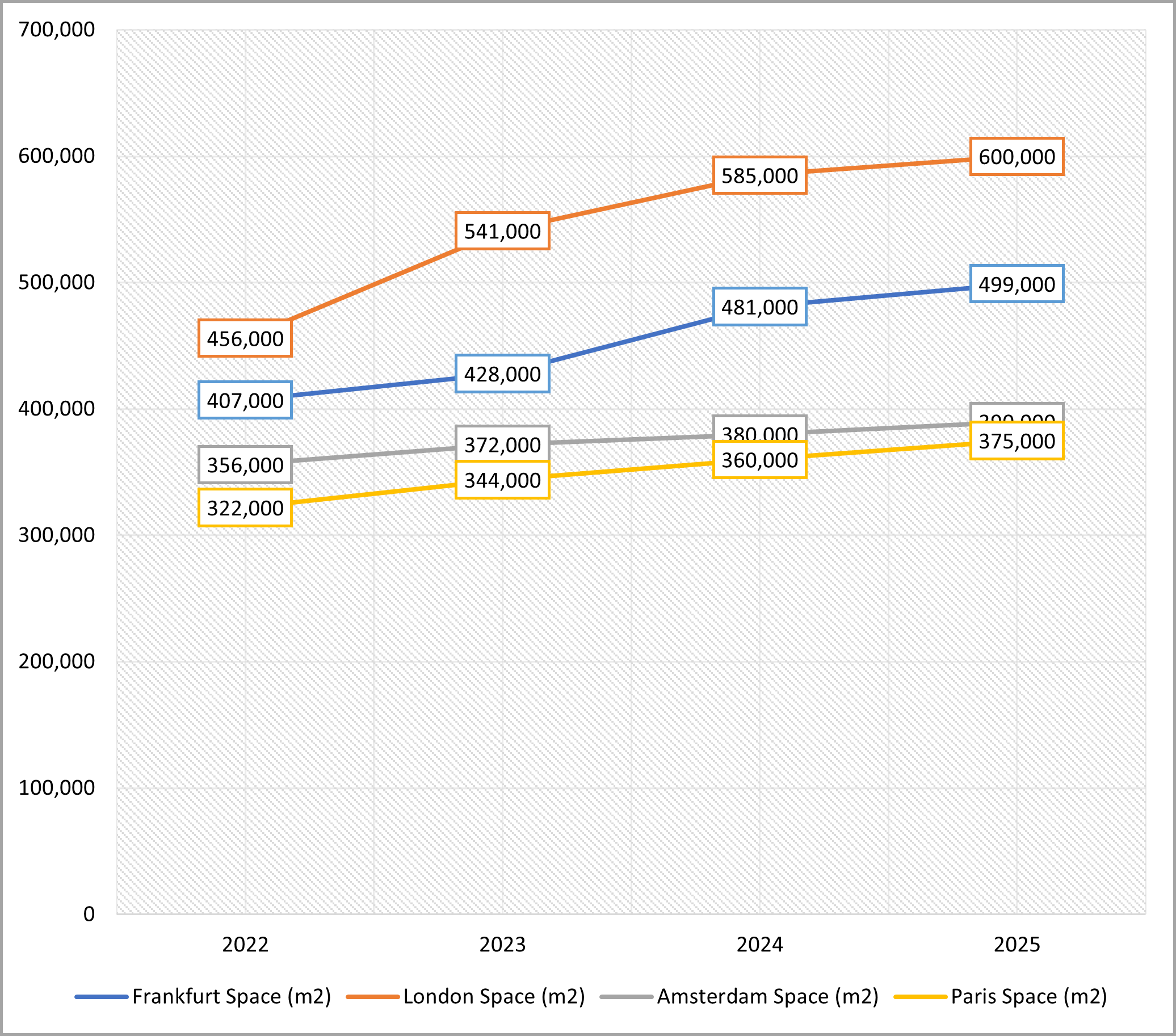

In the table in Figure 2 below DCP provides a comparison of the key country markets in Europe:

Figure 2 – A chart showing the size of comparable Data Centre country markets with Ireland (by Data Centre raised floor space in m2)

|

|

2020 |

2021 |

2022 |

2023 |

|

Germany |

660,000 |

720,000 |

780,000 |

860,000 |

|

Netherlands |

700,000 |

780,000 |

840,000 |

950,000 |

|

France |

510,000 |

550,000 |

600,000 |

660,000 |

|

UK |

910,000 |

950,000 |

990,000 |

1,030,000 |

|

Ireland |

550,000 |

680,000 |

780,000 |

890,000 |

Source: DCP (The forecast above is a combination of third-party Data Centre space and Hyperscale Data Centre space).

Including the Hyperscale Providers the total amount of Irish Data Centre space is now comparable with other Data Centre markets. Out of the four comparison countries the Netherlands has the highest Hyperscale presence (with Data Centres from Google and Microsoft), but is still less than Ireland.

The dominance of Data Centres in Ireland is due in large part to the investment by US technology giants with Microsoft alone employing 8,000 people and registering 150 companies in the country. Ireland is being used by Microsoft, Amazon and Google as a technology hub, to create and adjust software for the European market, with Data Centres used for production as well as storage. The Irish business model is markedly different from other European Data Centre hubs – with Amsterdam, Frankfurt and London relying on low latency and connectivity with a Data Centre ecosystem.

The shares of Data Centre space (Hyperscale and third-party combined) for the five countries (Germany, the Netherlands, France, the UK and Ireland) as of the end of 2020 is shown in the pie chart in Figure 3 below:

Including the Hyperscale Providers the total amount of Irish Data Centre space is now comparable with other Data Centre markets. Out of the four comparison countries the Netherlands has the highest Hyperscale presence (with Data Centres from Google and Microsoft), but is still less than Ireland.

The dominance of Data Centres in Ireland is due in large part to the investment by US technology giants with Microsoft alone employing 8,000 people and registering 150 companies in the country. Ireland is being used by Microsoft, Amazon and Google as a technology hub, to create and adjust software for the European market, with Data Centres used for production as well as storage. The Irish business model is markedly different from other European Data Centre hubs – with Amsterdam, Frankfurt and London relying on low latency and connectivity with a Data Centre ecosystem.

The shares of Data Centre space (Hyperscale and third-party combined) for the five countries (Germany, the Netherlands, France, the UK and Ireland) as of the end of 2020 is shown in the pie chart in Figure 3 below:

Figure 3 – A pie chart showing the share of Country Market Data Centre raised floor space as of the end of 2020 in per cent (Source: DCP)

Irish Key New Build Data Centres

Irish Data Centre space is also set to grow over the next two years. DCP examines the plans to build the new large Irish third-party Data Centres by CyrusOne and Echelon Data Centres, starting with CyrusOne below:

i) CyrusOne – CyrusOne is a US-based Data Centre REIT (Real Estate Investment Trust) which opened its first Data Centre facility (DUBLIN I) in Q4 2020 - with 3,000 m2 of space and 6 MW of power launched in the first phase of development.

The CyrusOne DUBLIN I is to be composed of three buildings of 11,148 m2 of Data Centre raised floor space and 18 MW of power making a total of 33,445 m2 of space and 54 MW of IT load over the whole campus when complete.

ii) Echelon Data Centres – Established in 2017 Echelon Data Centres is a subsidiary of UK-based property company Aldgate Developments. Echelon Data Centres has arranged construction funding with infrastructure funds Pioneer Point Partners and Davidson Kempner for two new Data Centre campuses including:

Arklow (DB-20 facility) – DB-20 is to provide a Data Centre campus of up to 45,000 m2 of space and up to 100 MW of power at Arklow in County Wicklow, South of Dublin, for a development cost of Euro €500 million, with the first phase to open in Q3 2022. The facility is located on a former Irish Fertilisers Industries at the Avoca Business Park – approximately one hour’s travel from Dublin Airport.

Clondalkin (DB-10 facility) – DB-10 is a Data Centre facility of up to 44,323 m2 of space and up to 100 MW of power. DB10 is located on the Clondalkin Industrial Estate near Dublin.

Echelon Data Centres is to specialise in the provision of space for large and medium users on long-term contracts, or with a powered shell for customised fit-outs. The two sites with planning permission have a claimed potential of 85,000 m2 of space and 184 MW of power in total.

iii) K2 Data Centres – K2 Data Centres are a subsidiary of Singaporean-based conglomerate the Kuok Group. K2 has an existing wholesale Data Centre located at the Ballycoolin Business Park (Dublin 1) with 18 MW of power and 9,000 m2 of space. K2 has three other Irish Data Centres under development including:

- K2 Dublin 2 – Phase 1 – Ballycoolin Campus – Located in North Dublin with 30 MW of power across 2 buildings with a launch date of 2022.

- K2 Dublin 2 – Phase 2 – Ballycoolin Campus – Located in North Dublin with 30 MW of power across 2 building with a launch date of 2023.

- K2 Dublin 6 – City West – Located in South Dublin with up to 8 MW of power, the site with planning permission was acquired in July 2020.

In total K2 Data Centres is due to add potential space of up to 34,000 m2 and 68 MW of power by the end of 2023.

CyrusOne, Echelon & K2 there is a total of over 152,000 m2 of Irish 3rd party Data Centre space under development, compared with a total of 122,000 m2 of Irish Data Centre space available as of the end of 2020 – more than double the current market size.

Irish Forecast Data Centre Growth

In the chart in Figure 4 below DCP shows a forecast of the growth for 3rd party Irish Data Centre equipped raised floor space from the end of 2020 to the end of 2023:

Figure 4 – A chart showing the forecast growth in Irish 3rd party equipped Data Centre floor space - from the end of 2020 to the end of 2023 in m2

Source: DCP

Despite the increase in the construction of Irish Data Centre facilities, it is likely that equipped space will only be released onto the market in response to anchor tenants and funding – with Irish third-party Data Centre space forecast to be added at the rate of 20,000 m2 up to 30,000 m2 per annum from 2020 onwards – double the traditional rate of space increase added prior to 2020.

It is conceivable that more facilities can be introduced. Additionally, Echelon Data Centres has two further Irish Data Centre facilities awaiting planning approval (and funding). The DB-30 facility based at the Grange Castle Business Park in South Dublin has potentially 42,000 m2 of space and 100 MW of power but has yet to receive funding, and there are outline plans to build another Data Centre campus (DB-40) also at County Wicklow - which is awaiting planning permission.

Equinix, the US-based REIT, has also applied for planning permission to expand its existing Dublin facility, and in September 2018 purchased an 8.2 acre site at Ballycoolin, close to an existing Equinix facility, but as yet the site has not been developed.

The key new third-party Data Centre colocation facilities being planned are shown in the table in Figure 5 below:

Figure 5 – A table showing the key new 3rd party Data Centre colocation facilities under development in Ireland

|

Data Centre Provider |

Facility |

Location |

Space (m2) |

Power (MW) |

Launch date |

Status |

|

CyrusOne |

DUBLIN I |

Grange Castle Business Park |

33,445 |

54 |

Q4 2020 |

Building |

|

Echelon Data Centres |

DB10 |

Clondalkin Industrial Estate |

44,323 |

100 |

Q3 2021 |

Building |

|

Echelon Data Centres |

DB20 |

Arklow, County Wicklow |

45,000 |

100 |

Q3 2022 |

Building |

|

Echelon Data Centres |

DB30 |

Grange Castle Business Park |

42,000 |

100 |

TBA* |

In Planning |

|

Echelon Data Centres |

DB40 |

Arklow, County Wicklow |

42,000 |

100 |

TBA* |

Land acquired |

|

K2 Data Centres |

K2 DUB1 |

City West |

4,000 |

8 |

2019 |

Land acquired |

|

K2 Data Centres |

K2 DUB 2-3 |

Ballycoolin Business Park |

15,000 |

30 |

2022 |

Land acquired |

|

K2 Data Centres |

K2 DUB 5-5 |

Ballycoolin Business Park |

15,000 |

30 |

2023 |

Land acquired |

|

|

|

Totals |

240,768 m2 |

522 MW |

|

|

Source: DCP (* TBA = To Be Announced)

Conclusions – Irish Data Centre Outlook

DCP forecasts that the amount of equipped Data Centre raised floor space in Ireland will increase by up to 74,000 m2 over the next three-year period from the end of 2020 to the end of 2023 – an overall increase of over sixty per cent – reflecting the size of the large third-party Data Centre sites being introduced from 2020 onwards.

To date all of the Data Centre facilities are located around the Dublin area – with the partial exception of the Echelon Data Centre (County Wicklow) located one hour south of Dublin along the coast.

However, the large new Data Centre projects frequently depend on financing and anchor tenants. Past Data Centre build outs depend on Data Centre Providers finding anchor tenants which favours a Data Centre Provider with an existing ecosystem of multi-national clients worldwide - including US-based Digital Realty, CyrusOne and Equinix.

New entrants Echelon Data Centres and K2 Data Centres will need to attract large enterprise & wholesale clients as an anchor tenant if they are to be successful, or possibly rent data halls to the other Irish Data Centre Providers. Ireland’s success has been built on the presence of US-based enterprises establishing a European base in the Dublin area. The arrival of K2 and investment by companies such as tik tok in new Data Centre capacity may herald another surge of international investment in Ireland from Asia.

European Data Centre hubs such as London, Frankfurt and Amsterdam have been established through connectivity, low latency and their proximity to large markets. Dublin is stimulated by investment from companies using Data Centres to store e-commerce, IT & intellectual property and is a unique market compared with the rest of Europe’s Data Centre hubs.

See blog posts tagged...

- Amsterdam [1]

- Asia-Pacific [2]

- Australia [1]

- Brexit UK [1]

- Carbon Neutral [1]

- China [2]

- Cloud services [1]

- Co-location [1]

- Cyrus [1]

- Data Centre Capex costs [1]

- Data Centre Growth [1]

- datacentre [1]

- DC Consolidation [1]

- DC Expansion [2]

- DC Investment [1]

- DC Power [3]

- DC Pricing [1]

- DC Trends [3]

- Denmark [1]

- Echelon [1]

- EMEA [1]

- Energy [1]

- Europe [1]

- Flap European cities [1]

- Frankfurt [1]

- Global [1]

- Hong Kong [1]

- Hyperscale [1]

- Indonesia [1]

- Ireland [1]

- IT outsourcing [1]

- Japan [1]

- K2 [1]

- London [1]

- Malaysia [1]

- Migration to the cloud [1]

- Netherlands [1]

- Paris [1]

- Planning [1]

- Singapore [1]

- South Korea [1]

- Spain [1]

- Sweden [1]

- Taiwan [1]

- Thailand [1]

- UK [1]

- Vietnam [1]

Blog archive...

- 2022 [2]

- 2021 [3]

- January [1]

- February [1]

- June [1]

- 2020 [7]

- June [2]

- August [2]

- 8 Aug 2020 : Data Centre Blog 4.0: What the Municipality of Amsterdam tells us about future Data Centre development

- 17 Aug 2020 : Data Centre Blog 3.0: The expansion of Data Centre capacity throughout Europe – 11 out of 15 countries are seeing growth, almost 700,000 m2 of Data Centre raised floor space

- September [1]

- October [1]

- November [1]

Company Address: 47 Cecil Road, London, W3 0DB Company No: 5015163 VAT No: 882 2827 93