Blog

Data Centre Blog 1.0: UK Data Centres face a more challenging future

30 June 2020

Ahead of the publication of the latest UK Data Centre Trends report, DCP Research Director Keith Breed looks at the key changes taking place in the UK Data Centre market.

The Data Centre UK market has long been driven by IT outsourcing, migration to the cloud & cloudified services, with the cloud becoming the largest customer segment The UK remains in the Top Tier of Data Centre price levels and capacity in Europe. Along with Denmark, Ireland & Switzerland the UK has the highest average price levels in Europe. The UK remains the largest Data Centre market in Europe dominated by the Inner London & M25 & Slough city clusters areas.

The key UK Pricing Trends

UK pricing is increasingly dictated by the amount of connectivity. Those UK Data Centres with superior connectivity are able to command higher price levels, with providers such as Equinix also putting in place annual price escalators for RPI and power costs. But there remains a considerable range of pricing – with price differences remaining between UK cities and within the Inner London & M25 area.

Equinix and other Data Centre Providers have increased price levels in London & Slough. But the UK has a number of regional Data Centre clusters, in Cardiff, Reading, Manchester, Newcastle and Leeds where price levels have either fallen or remain stable. Over the past 3 years, due to the emergence of regional Data Centre clusters, the average UK basket of pricing has fallen by 10 per cent. There is a spread of Data Centre pricing of 3.6 times in the UK market, the 4th highest spread of pricing in Europe.

UK Data Centres now faces new challenges

UK Data Centres now face new challenges. UK utility costs remain stubbornly high and vie with Ireland and Germany as being among the highest electricity costs in Europe – with power costs more than double the kWH rate of Scandinavian countries such as Sweden, Denmark and Norway.

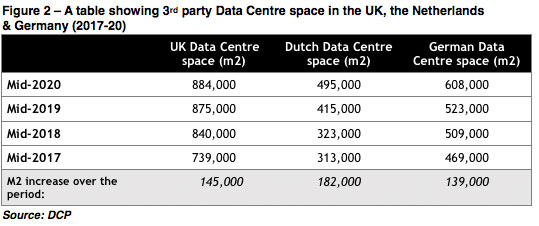

And over the last few years new Data Centre space has continued to be added in the UK. But main continental rivals the Netherlands and Germany have seen faster overall growth in Data Centre space, as indicated in the table below:

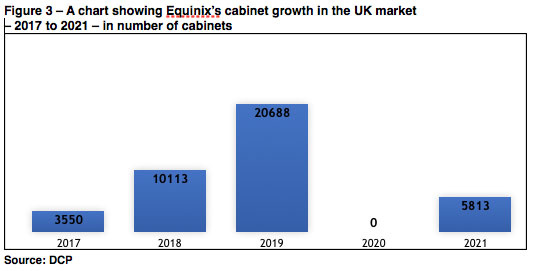

Equinix, one of the largest Data Centre Providers in the UK has launched a range of new cabinets of space over the past four x years from 2017 to 2021 shown in the chart below:

Since 2017 Equinix has increased the number of cabinets (racks) in the UK (mainly in Slough) by over 40,000 cabinets, equivalent to 100,000 m2 of Data Centre raised floor space (the figure shown for 2021 is for new Equinix space announced in Q1 2021).

The London & Inner M25 Data Centre Cluster faces competition from Amsterdam and Frankfurt which have overtaken London to become the largest connectivity hubs in Europe – with London falling into third place just ahead of the Paris city area.

Frankfurt & Amsterdam in particular are experiencing a Data Centre building boom with lower average price levels & lower kWH power rates applying in Amsterdam. The potential fallout from Brexit has become a factor as well, with new capacity outside the UK being added by enterprises concerned by EU data sovereignty and GDPR compliance concerns.

Although new UK Data Centre capacity is being added by NTT (Global Data Centers) and Virtus Data Centres, DCP expects the slowdown in new UK Data Centre growth to continue into 2021.

See blog posts tagged...

- Amsterdam [1]

- Asia-Pacific [2]

- Australia [1]

- Brexit UK [1]

- Carbon Neutral [1]

- China [2]

- Cloud services [1]

- Co-location [1]

- Cyrus [1]

- Data Centre Capex costs [1]

- Data Centre Growth [1]

- datacentre [1]

- DC Consolidation [1]

- DC Expansion [2]

- DC Investment [1]

- DC Power [3]

- DC Pricing [1]

- DC Trends [3]

- Denmark [1]

- Echelon [1]

- EMEA [1]

- Energy [1]

- Europe [1]

- Flap European cities [1]

- Frankfurt [1]

- Global [1]

- Hong Kong [1]

- Hyperscale [1]

- Indonesia [1]

- Ireland [1]

- IT outsourcing [1]

- Japan [1]

- K2 [1]

- London [1]

- Malaysia [1]

- Migration to the cloud [1]

- Netherlands [1]

- Paris [1]

- Planning [1]

- Singapore [1]

- South Korea [1]

- Spain [1]

- Sweden [1]

- Taiwan [1]

- Thailand [1]

- UK [1]

- Vietnam [1]

Blog archive...

- 2022 [2]

- 2021 [3]

- January [1]

- February [1]

- June [1]

- 2020 [7]

- June [2]

- August [2]

- 8 Aug 2020 : Data Centre Blog 4.0: What the Municipality of Amsterdam tells us about future Data Centre development

- 17 Aug 2020 : Data Centre Blog 3.0: The expansion of Data Centre capacity throughout Europe – 11 out of 15 countries are seeing growth, almost 700,000 m2 of Data Centre raised floor space

- September [1]

- October [1]

- November [1]

Company Address: 47 Cecil Road, London, W3 0DB Company No: 5015163 VAT No: 882 2827 93