Blog

Data Centre Blog 11.0 - January 2022 - Power & Planning – The crucial test for Data Centres in 2022

31 January 2022

The key trends for Data Centres in 2022 – What are the main changes forecast for 2022?

Below DCP analyses the 6 main trends impacting the European Data Centre market in 2022. Although the increase in the European Data Centre market continues some markets will experience constraints on their growth. And the demands of the largest Hyperscale Data Centres will become a political issue as more scarce renewable energy resources risk being devoted to a handful of Data Centre players.

The six key Data Centre trends for 2022 are interlinked by Power and Planning (P&P. Below DCP looks at the 6 key Data Centre trends in more detail:

Trend 1: Although there has been substantial growth in the FLAP markets it is unlikely to be sustained across all markets into 2022:

The FLAP Data Centre markets (including the city areas of Frankfurt, London, Amsterdam and Paris) have become the largest Metro markets in Europe and have traditionally accounted for the most Data Centre power and space development. However, some of the FLAP markets are now experiencing constraints on future growth, particularly of power availability, as the number of Data Centres in a particular Metro area places a strain on the local national grid.

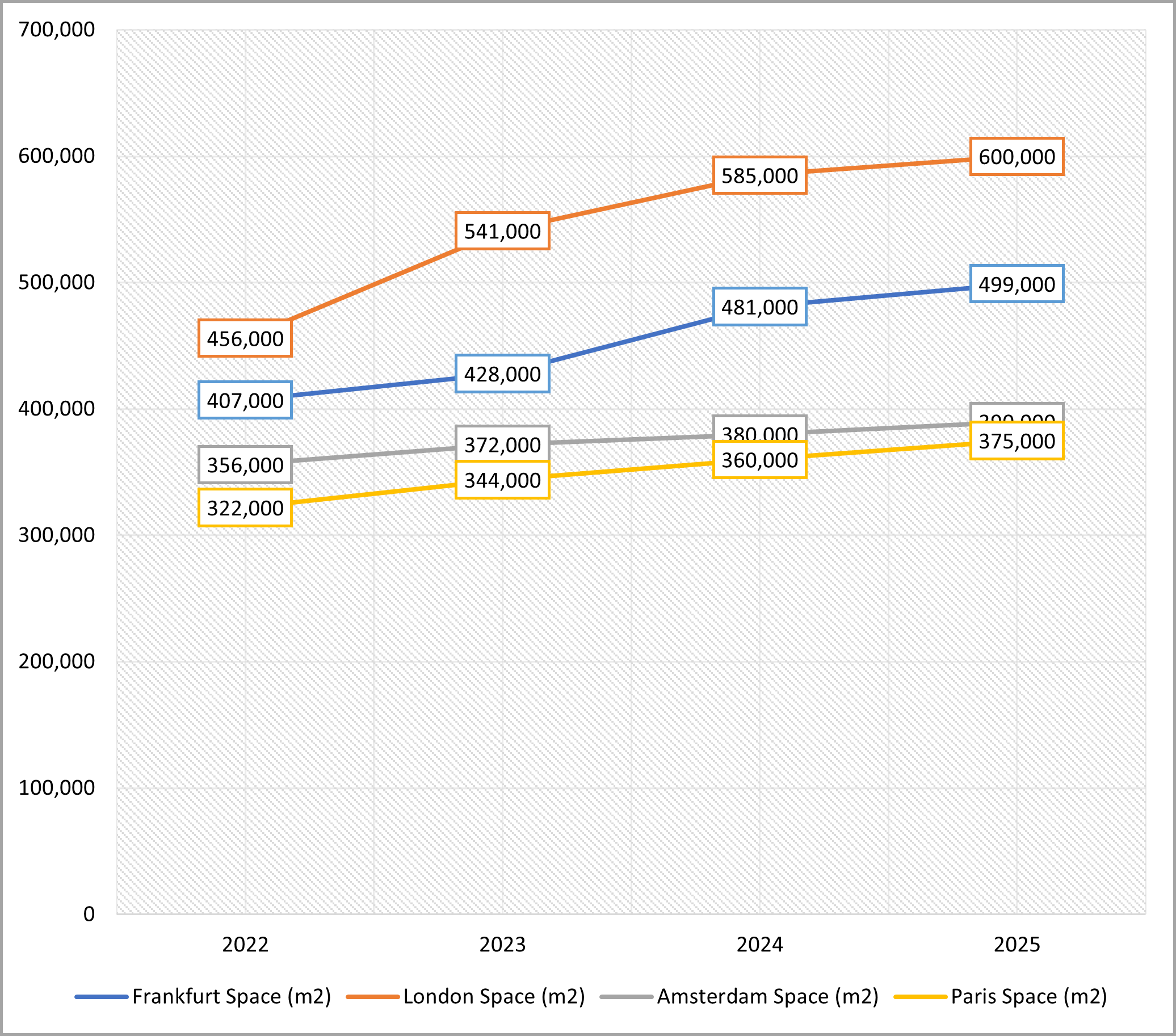

As a result, growth rates for the FLAP markets growth rates are starting to diverge. DCP has analysed the FLAP market Data Centre growth rates - in MW of power and m2 of Data Centre raised floor space - from the beginning of 2022 to the beginning of 2027 shown in the table in Figure 1 below:

Figure 1: A table showing the FLAP market Data Centre growth by power and space (in MW & m2) – forecast from the beginning of 2022 to the beginning of 2025

Source: DCP (forecasts are based on Data Centre announcements made as of January 2022)

The divergence in forecast FLAP Data Centre market growth can be seen more clearly in a chart format - as shown below in Figure 2 from the beginning of 2022 to the beginning of 2025:

Figure 2: A chart showing the forecast FLAP market Data Centre growth by space in m2 (from the beginning of 2022 to the beginning of 2025)

The divergence means that Frankfurt and London & Slough Metro markets are seeing the most significant growth in new Data Centre space & power (in particular Frankfurt & Slough). London & Slough is to grow by 144,000 m2 & Frankfurt by 92,000 m2 over the next 3 year period.

By contrast Paris is to grow by 53,000 m2 & Amsterdam by 34,000 m2 over the same period.

Already the total Data Centre power across the 4 FLAP markets is over 2,300 MW (as of the beginning of 2022) and is forecast to grow to almost 2,900 MW by the beginning of 2025.

The implication is that during 2022 onwards large Data Centre projects will come under closer scrutiny with planning approval being subject to minimizing their impact on the local environment and the provision of a sustainable facility with a reduced power footprint.

The pressure on utility providers – and their inability to provide sufficient power - means that there will be a migration to those Data Centre Metros with available power reserves and abundant power generation capacity (including renewable power) which will favour the Nordics Region as a Data Centre destination.

Trend 2: Sustainable facilities are set to become the key differentiator for the Data Centre Provider in 2022:

Sustainable Data Centre facilities are set to become a key requirement for their customers as ESG (Environment, Social Governance) benchmarking becomes a common corporate objective. Data Centre Providers are also reporting that their Hyperscale customers are demanding renewable power and a more sustainable Data Centre facility as part of a key criteria in their RFP’s.

Sustainability will require more meaningful measurements than just a low PUE metric, with facilities being assessed for both their direct and indirect impact on the environment (through their supply chains for example).

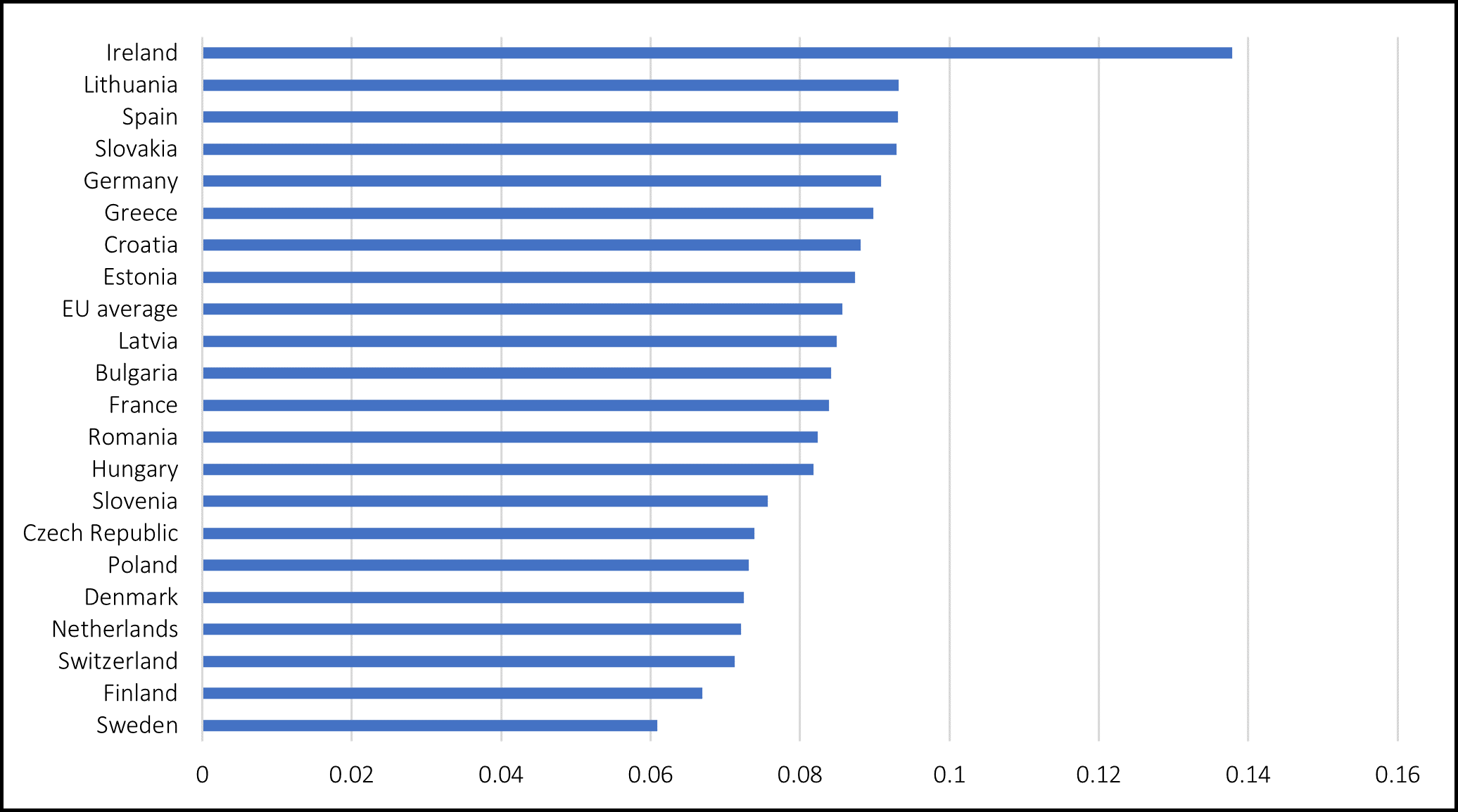

Finally, the cost of energy is increasing across Europe. But what is striking is that the cost differences by European Country remains similar, with Sweden, Finland & Norway being among the low-cost power regions and Ireland, the UK & Germany being among the highest cost regions.

The latest forecast power costs for selected countries are shown in the chart shown in Figure 3 below (provided from Eurostat, the EC’s statistics agency for the 2nd half of 2021):

Figure 3: A chart showing the forecast power costs in Euro - per kW Hour (2nd half of 2021)

S

The ability to source low-cost renewable power will become a key determinant for Data Centres during 2022 – favouring markets where there is a power generation surplus.

Trend 3: Cloud Service Providers will teach Data Centre Providers how to monitor their environmental impact in 2022:

Selected Cloud Service Providers (CSPs) have introduced online tools for their users to monitor their carbon footprint, a service which Data Centre Providers will need to emulate through their own online service management portals.

Microsoft Azure Cloud has developed a series of dashboards for users to compare their cloud power usage and carbon reduction with a colocation alternative.

Microsoft Azure Cloud first introduced its Emissions Impact Dashboard in January 2020 which was made widely available in October 2021. It allows businesses to view the greenhouse gas emissions associated with Microsoft Azure Cloud, with views by month, service or cloud region.

The Dashboard now allows users to track indirect emissions (so-called Scope 3) across all of the product chain including materials used, manufacture, transport, usage and hardware disposal.

A screenshot from the Microsoft Azure Cloud Emissions Impact Dashboard is shown in Figure 4 below:

Trend 4: New Data Centre Metros will step up in 2022 to rival traditional Metro markets:

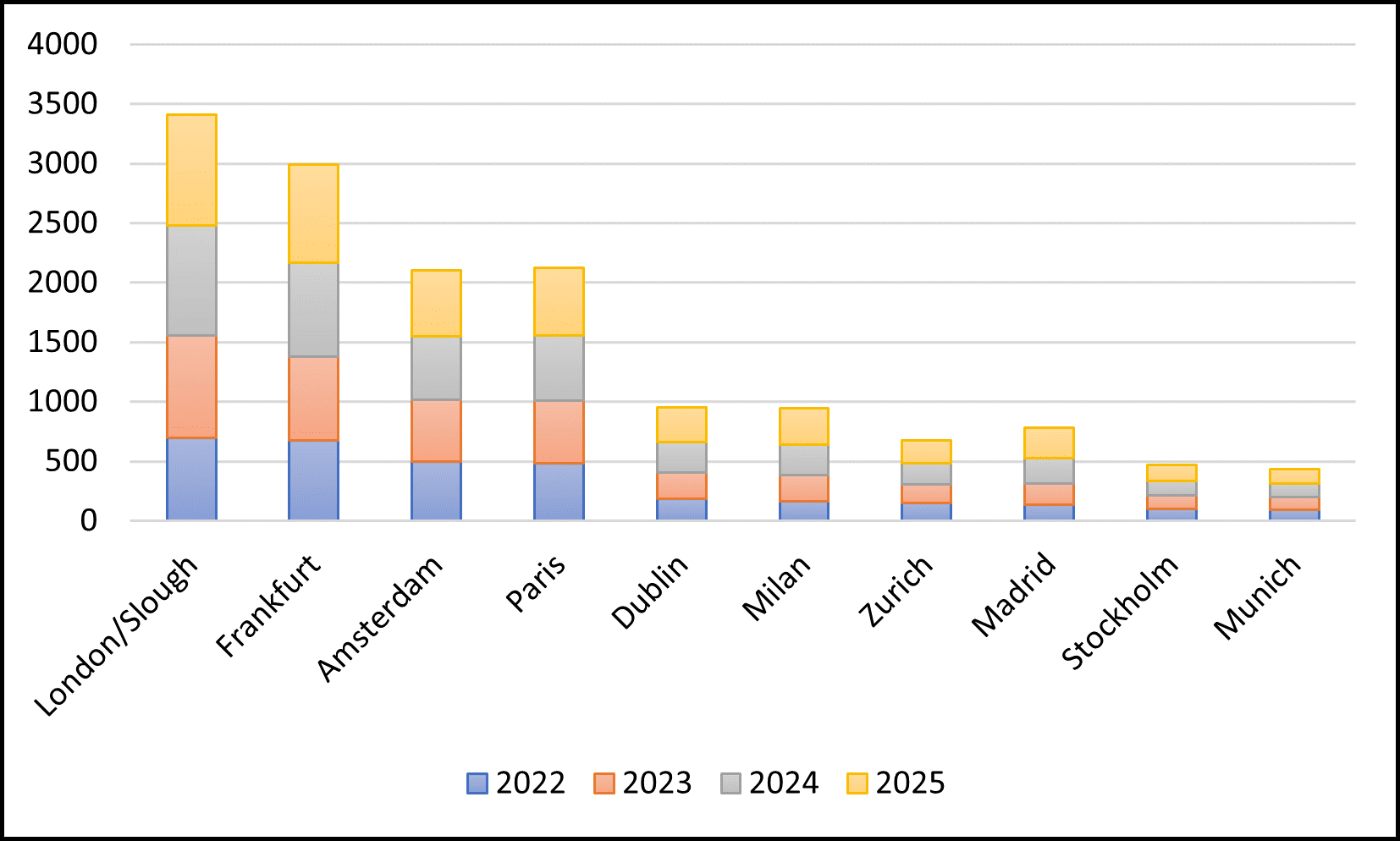

Data Centre Metros in Europe are growing at different rates. To date the Data Centre Metros with the largest percentage growth are relatively new and a are growing rapidly from a low installed base. The new fast-growing European Data Centre Metros include Barcelona, Marseille and Madrid.

Other Tier 2 Data Centre markets of Milan, Rome, Warsaw and Zurich are also seeing sharp growth in new Data Centre capacity as Hyperscale Data Centre and Cloud deployments take root in 2022.

DCP has analysed the announced Data Centre expansions across Europe with the UK having the highest absolute growth rates in new capacity, followed by Ireland, Germany, Italy, France and Spain. The forecast increase in the 10 largest European Data Centre Metro markets by MW of power are shown in the chart in Figure 4 below:

Figure 4: The forecast increase in the largest European Metro Data Centre markets by power (in MW) from the beginning of 2022 to the beginning of 2025

But all of the Data Centre markets will face common challenges and opportunities with their Data Centre expansions in 2022 including:

- Sufficient Power Availability: with increasing power demands placing a strain on local grid infrastructure (including the Netherlands and Ireland)

- Sufficient Renewable Power Availability: with Hyperscale Data Centres requiring renewable power and taking a high proportion of the available renewable power (including the Netherlands)

- Location becomes Crucial for Content: with some Data Centres acting as content hubs, if they can provide access to sub-sea cables with international connectivity access (including Genoa (Italy) & Marseille (France)).

- New Data Centres will boost under-served markets: with new Data Centres & Cloud access being built in relatively under-served markets (including Greece, Italy, Portugal & Spain) allowing content and cloud access to be offered to a wider number of users in these markets.

Trend 5: In 2022 Data Centre Providers will have to invest in their own power infrastructure:

In order to build out their new large Hyperscale Data Centre facilities Data Centre Providers will need to fund developments in new power infrastructure. In Ireland new Data Centres are being built on condition that there is investment in local power infrastructure. For example, Echelon Data Centres is building a new electricity sub-station to power its DUB10 facility at the Clondalkin Industrial Park on the outskirts of Dublin to provide up to 60,000 m2 of space and 90 MW of power.

In order to gain planning approval and offset the pressure on the local power grid, large Data Centre developments will need to also develop the local power infrastructure as part of the facility.

Trend 6: Governments finally step in to define their own national Data Centre planning rules:

In most countries Data Centres are subject to local planning rules and approval. In practice this has been applied on a case by case basis with local municipalities weighing the advantages of new investment on the local economy against the impact on the environment. This laisez-faire approach has enabled the implementation of a number of large Hyperscale Data Centres. But now Governments have started to implement a national planning policy for Data Centres which overrules the local municipalities.

During 2021 in the Netherlands two municipalities placed a temporary moratorium on Data Centre developments in the Amsterdam area which were lifted in August 2021. Planning in the Netherlands has been decided at a local (municipal) level, but a new national Dutch Government is to decide Data Centre planning at a national level due to the impact on power usage.

Other countries have also been considering a national Data Centre planning policy. In Ireland the national utility EirGrid has forecast that Data Centres will amount to 25% of Irish energy usage by 2030. The Dutch Datacentre Association forecasts that Data Centres will account for 10% of total Dutch energy usage by 2030 (up from 3% in 2021) – and as their power impact grows Data Centre planning policy will become a significant public political issue.

See blog posts tagged...

- Amsterdam [1]

- Asia-Pacific [2]

- Australia [1]

- Brexit UK [1]

- Carbon Neutral [1]

- China [2]

- Cloud services [1]

- Co-location [1]

- Cyrus [1]

- Data Centre Capex costs [1]

- Data Centre Growth [1]

- datacentre [1]

- DC Consolidation [1]

- DC Expansion [2]

- DC Investment [1]

- DC Power [3]

- DC Pricing [1]

- DC Trends [3]

- Denmark [1]

- Echelon [1]

- EMEA [1]

- Energy [1]

- Europe [1]

- Flap European cities [1]

- Frankfurt [1]

- Global [1]

- Hong Kong [1]

- Hyperscale [1]

- Indonesia [1]

- Ireland [1]

- IT outsourcing [1]

- Japan [1]

- K2 [1]

- London [1]

- Malaysia [1]

- Migration to the cloud [1]

- Netherlands [1]

- Paris [1]

- Planning [1]

- Singapore [1]

- South Korea [1]

- Spain [1]

- Sweden [1]

- Taiwan [1]

- Thailand [1]

- UK [1]

- Vietnam [1]

Blog archive...

- 2022 [2]

- 2021 [3]

- January [1]

- February [1]

- June [1]

- 2020 [7]

- June [2]

- August [2]

- 8 Aug 2020 : Data Centre Blog 4.0: What the Municipality of Amsterdam tells us about future Data Centre development

- 17 Aug 2020 : Data Centre Blog 3.0: The expansion of Data Centre capacity throughout Europe – 11 out of 15 countries are seeing growth, almost 700,000 m2 of Data Centre raised floor space

- September [1]

- October [1]

- November [1]

Company Address: 47 Cecil Road, London, W3 0DB Company No: 5015163 VAT No: 882 2827 93