Blog

Data Centre Blog 6.0 – The impact of Data Centre Consolidation and Expansion in Europe

27 October 2020

Consolidation is taking place in the European Data Centre market and Expansion in Frankfurt and London (Slough), with Equinix the biggest player in Slough, and NTT (Global Data Centers) the biggest player in Frankfurt.

DCP considers the emergence of three key Pan-European Data Centre Providers, Equinix, Interxion (now owned by Digital Realty) and Global Data Centers (owned by NTT Ltd).

The three Data Centre Providers of Equinix, Interxion/Digital Realty & Global Data Centers (NTT Ltd) account for an increasing market share of the largest European Data Centre markets focusing on the so-called FLAP markets of Frankfurt, London, Amsterdam and Paris). They are also expanding into secondary markets in these countries (including Berlin, Marseille & Manchester).

Background

Equinix, a US-based REIT (Real Estate Investment Trust) originally entered the European Data Centre market with the acquisition of IXEurope in 2007. It then followed up with the larger acquisition of Pan-European Data Centre Provider Telecity at the beginning of 2016.

Most recently Interxion, a Pan-European Data Centre Provider, was acquired by US REIT Digital Realty in March 2020, adding 53 facilities in 11 countries to its existing footprint in the UK, Ireland, the Netherlands and Germany.

And Global Data Centers, a subsidiary of NTT Ltd, has recently integrated its Data Centre assets acquired from Gyron Internet Ltd (UK - initially acquired in 2012) and e-shelter (Germany - initially acquired in 2008).

The FLAP markets in Europe

These three Data Centre Providers together have 89 Data Centre facilities across the four city markets with total space in the four cities (Frankfurt, London, Amsterdam and Paris) of 514,000 m2.

The three Data Centre Providers have concentrated their investment in the key markets of Frankfurt, London (including Slough), Amsterdam and Paris - with the amount of Data Centre space per city market by Data Centre Provider also shown in the chart in Figure 1 below:

Figure 1 – A chart showing the breakdown of Data Centre space by city market in m2

Source: DCP

It is striking that the two largest Data Centre clusters are formed by Equinix in London (its Slough campus) and Global Data Centers in Frankfurt (formerly e-shelter). Both have over 80,000 m2 of Data Centre raised floor space.

The four FLAP (Frankfurt, London, Amsterdam, Paris) markets account for the majority of Data Centre space in Europe with over 1.3 million m2 of Data Centre raised floor space in total across the four cities and almost 2,000 MW of Data Centre power in total.

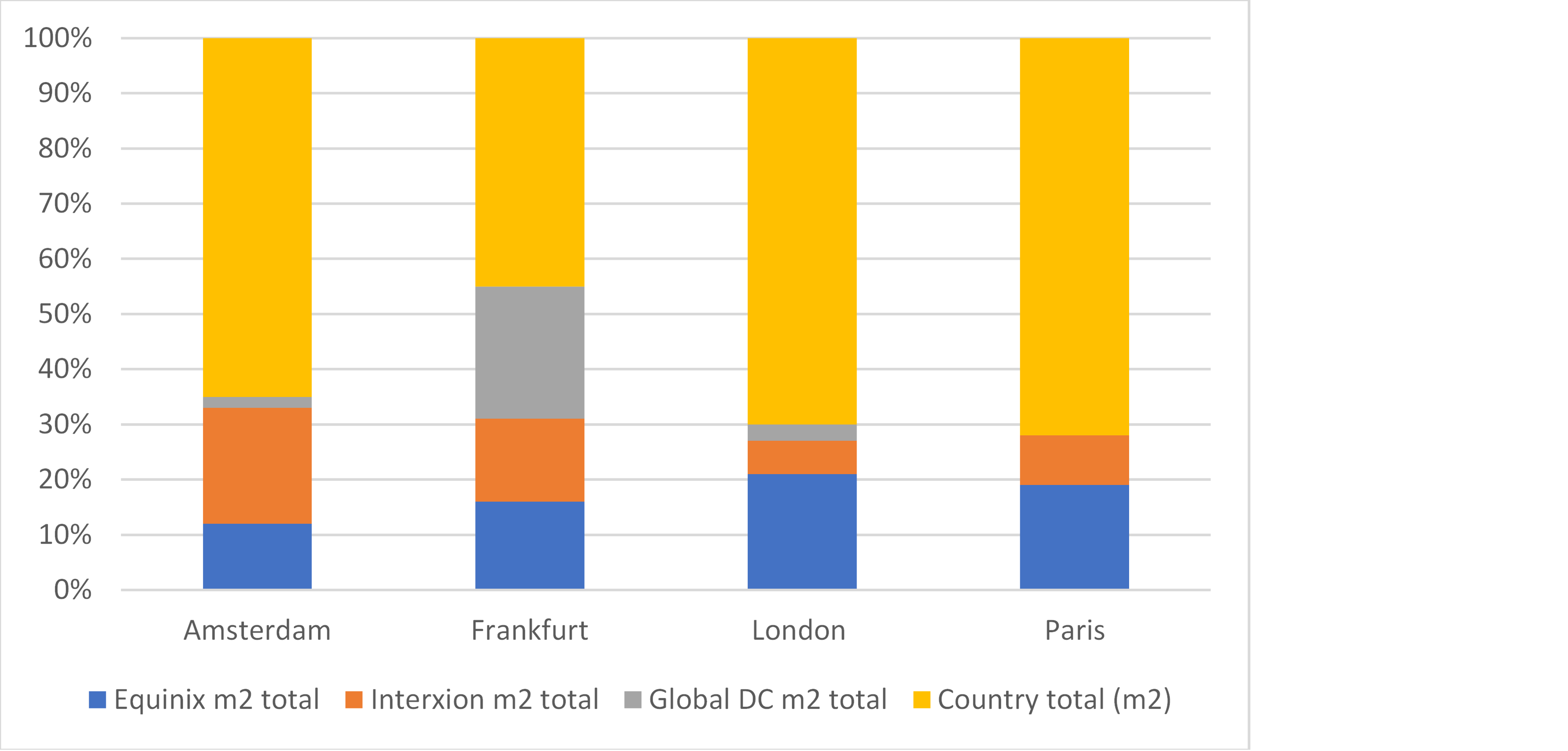

The relative market shares by Data Centre Provider in each of the three city markets, as a percentage of their Data Centre space, are shown in the chart below:

Figure 2 – A chart showing the breakdown of Data Centre space by DC and by city market in m2

Source: DCP

The chart below reveals the share each of the 3 Data Centre Providers has in each of the four FLAP markets, with Paris having the largest share of 72 per cent served by other Data Centre Providers followed by London with 70 per cent.

Figure 3 – A pie chart showing the Data Centre market shares in each of the four cities (as a percentage of total m2 of space) Source: DCP

About Equinix in Europe

In the FLAP (Frankfurt, London, Amsterdam and Paris) markets Equinix currently has 37 Data Centre facilities with approximately 231,000 m2 of Data Centre raised floor space, and 97,000 m2 for other European cities with significant hubs located in - Stockholm, Helsinki, Milan and Zurich.

Equinix has disclosed the following plans to build new Data Centre facilities in Europe in the cities Manchester (UK), Bordeaux (France), Hamburg (Germany), Milan (Italy) and Paris (France).

The Equinix has most space in the FLAP cities, 231,000 m2 in the FLAP cities versus 97,000 m2 for other European cities – and has a split of 70 per cent of total European space for the FLAP markets.

About Global Data Centers in Europe

In the FLAP markets, Global Data Center currently has 8 Data Centre facilities with large campus-style facilities – with 107,000 m2 of Data Centre raised floor space. Global Data Centers London facility (Dagenham) is being built out in phases (with only the first phase shown in the table in Figure 10). As yet the company has not invested in the Paris market.

Beyond the four FLAP markets, Global Data Centers has 10 facilities with a total of 61,500 m2 of Data Centre Raised floor space in Vienna (Austria), Zurich (Switzerland) and Hamburg, Munich, Berlin and Bonn – Rhine and Ruhr (Germany) – as well as three established Data Centre facilities at Hemel Hempstead north of London.

Currently, Global Data Centers has a split of almost 64 percent between Data Centre space in the FLAP cities and non-FLAP markets with more space to be added to the non-FLAP market in Berlin in particular.

About Interxion/Digital Realty in Europe

In the FLAP markets, Interxion/Digital Realty together currently has 48 Data Centre facilities with approximately 176,000 m2 of Data Centre space.

Outside the FLAP markets & Dublin, Interxion has facilities in – Brussels (Belgium), Copenhagen (Denmark), Dublin (Ireland), Marseille (France), Stockholm (Sweden), Vienna (Austria), with Digital Realty also having a number of facilities in Brussels (Belgium), Copenhagen (Denmark), Stockholm (Sweden), Vienna (Austria), the UK (outside of the London area), Marseille (France) and Zurich (Switzerland),

Recently Interxion/Digital Realty has announced plans to expand its presence in a series of European markets including in the cities Vienna (Austria), Frankfurt (Germany) and Paris (France)

Interxion and Digital Realty has 35 Data Centre facilities outside of the key FLAP & Dublin cities with total space of almost 165,000 m2 – with 35 per cent of the non-FLAP capacity being Digital Realty facilities around the South East of the UK.

Conclusions – A FLAP market focus is the common factor for Equinix, Global Data Centers & Interxion/Digital Realty.

The European Data Centre market is consolidating with a series of recent acquisitions - In March 2020 Interxion was acquired by Digital Realty for USD $8.4 billion, and Vantage Data Centers acquired Etix Everywhere in February 2020 and Next Generation Data (UK) in April 2020. Despite the consolidation, Equinix, Digital Realty/Interxion & Global Data Centers together account for 37 per cent of Data Centre capacity in the FLAP markets. But there still remains a number of regional and local players providing competition in each market.

Frankfurt has seen considerable investment in new capacity and has become the single largest Data Centre cluster in Europe – Frankfurt has become the largest city cluster and a connectivity hub with Global Data Centers (the former e-shelter) continuing to develop their presence in Frankfurt. Global Data Centers also continue to develop space elsewhere in Germany - including Munich and Berlin – their main market in Europe.

Equinix has set the template for Data Centre facility pricing in Europe – Equinix continues to expand its presence in existing markets, particularly in Slough, their largest hub in Europe. Over time Equinix has continued to increase pricing for space, power & connectivity. It has also built in price escalators into customer contracts allowing for annual price increases and has become the Data Centre Provider to emulate.

With the acquisition of Interxion, Digital Realty is set to pursue a model similar to Equinix – Interxion is being integrated with Digital Realty, offering Platform Digital, a common control fabric across all facilities as a means of using connectivity to boost revenues. More large campus-style facilities are being created, notably by Interxion in Paris, which will allow data halls to be provided for either dedicated hyperscale customers or for retail colocation users.

Other Data Centre hubs of connectivity & content are being formed in Europe – The aim of the Data Centre Provider is to be a part of a wider content hub with ecosystem with a range of connectivity options, with Interxion implementing content hubs in Marseille, Madrid and Vienna as well as Frankfurt and Slough. A connectivity & content hub allows the Data Centre to provide more interconnects and services.

Should you be interested in purchasing the full report for GBP 195 , please click here.

See blog posts tagged...

- Amsterdam [1]

- Asia-Pacific [2]

- Australia [1]

- Brexit UK [1]

- Carbon Neutral [1]

- China [2]

- Cloud services [1]

- Co-location [1]

- Cyrus [1]

- Data Centre Capex costs [1]

- Data Centre Growth [1]

- datacentre [1]

- DC Consolidation [1]

- DC Expansion [2]

- DC Investment [1]

- DC Power [3]

- DC Pricing [1]

- DC Trends [3]

- Denmark [1]

- Echelon [1]

- EMEA [1]

- Energy [1]

- Europe [1]

- Flap European cities [1]

- Frankfurt [1]

- Global [1]

- Hong Kong [1]

- Hyperscale [1]

- Indonesia [1]

- Ireland [1]

- IT outsourcing [1]

- Japan [1]

- K2 [1]

- London [1]

- Malaysia [1]

- Migration to the cloud [1]

- Netherlands [1]

- Paris [1]

- Planning [1]

- Singapore [1]

- South Korea [1]

- Spain [1]

- Sweden [1]

- Taiwan [1]

- Thailand [1]

- UK [1]

- Vietnam [1]

Blog archive...

- 2022 [2]

- 2021 [3]

- January [1]

- February [1]

- June [1]

- 2020 [7]

- June [2]

- August [2]

- 8 Aug 2020 : Data Centre Blog 4.0: What the Municipality of Amsterdam tells us about future Data Centre development

- 17 Aug 2020 : Data Centre Blog 3.0: The expansion of Data Centre capacity throughout Europe – 11 out of 15 countries are seeing growth, almost 700,000 m2 of Data Centre raised floor space

- September [1]

- October [1]

- November [1]

Company Address: 47 Cecil Road, London, W3 0DB Company No: 5015163 VAT No: 882 2827 93